“The idea that the future is unpredictable is undermined every day by the ease with which the past is explained.” Daniel Kahneman

Daniel Kahneman, who passed away at age 90 earlier this year, was a psychologist best known for his work on the psychology of judgment and decision-making and behavioral economics. He and Vernon L. Smith were awarded the 2002 Nobel Memorial Prize in Economic Sciences for this work.

With the above thought in mind, and as managers prepare to complete their budgets for 2025, I thought it might be interesting to revisit market expectations of a year ago.

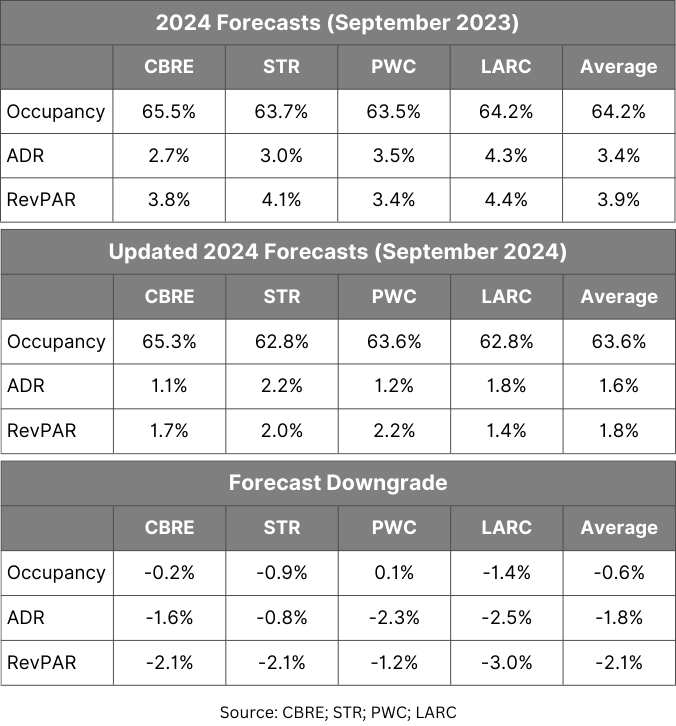

2024 Lodging Industry Forecast: Then & Now

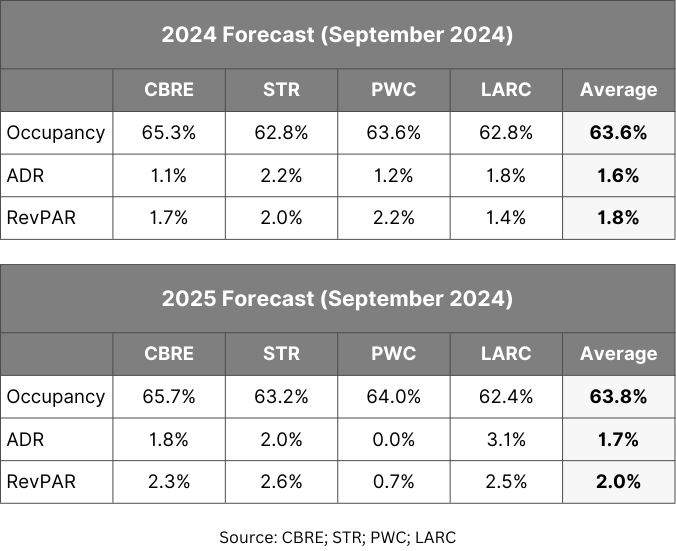

The 2024 U.S. market forecasts available in September 2023 from four well-known firms, CBRE, STR, PWC, and LARC, and their updated outlook as of September 2024 are summarized as follows:

Why The Downgrade?

What were market conditions a year ago, and how have they shifted since then to explain the more pessimistic outlook for 2024 expected by these four firms?

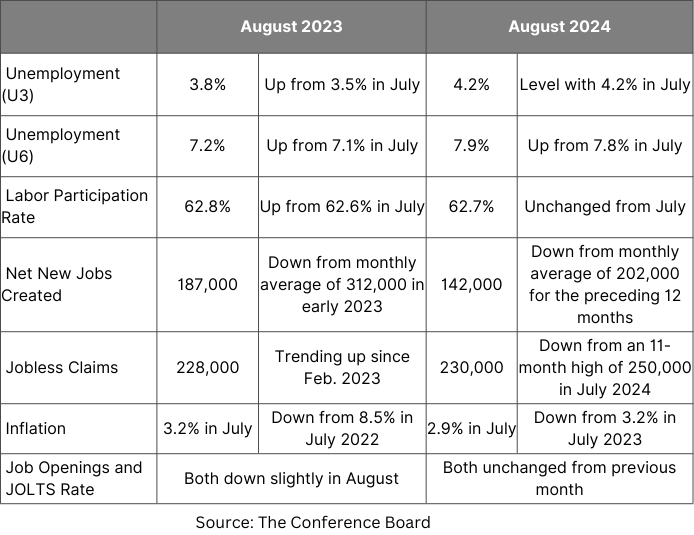

A year ago, The Conference Board’s monthly release for August 2023 included these highlights:

- “Consumer confidence fell in August 2023, erasing back-to-back increases in June and July.”

- “August’s disappointing headline number reflected dips in the current conditions and expectations indexes.”

- “…. consumers were once again preoccupied with rising prices, particularly for groceries and gasoline.”

- “The pullback in consumer confidence was evident across all age groups.”

Fast forward to where we are today. Dana M. Peterson, Chief Economist at The Conference Board, noted in their recent release for August 2024 that “overall consumer confidence rose in August but remained within the narrow range that has prevailed over the past two years.” Peterson said, “Consumers’ assessments of the current labor situation, while still positive, continued to weaken, and assessments of the labor market going forward were more pessimistic. This likely reflects the recent increase in unemployment. Consumers were also a bit less positive about future income.”

A snapshot of U.S. economic activity for August in 2023 and 2024 is as follows:

My take on the above is:

- The unemployment rate is up.

- The labor participation rate is slightly down.

- The level of job creation is significantly down.

- Jobless claims are slightly elevated.

- Inflation is down.

- Job openings and the volume of separations are 18.0% and 3.4% lower, respectively, than they were a year ago.

In summation, the economy is clearly slowing down.

What About the Year Ahead?

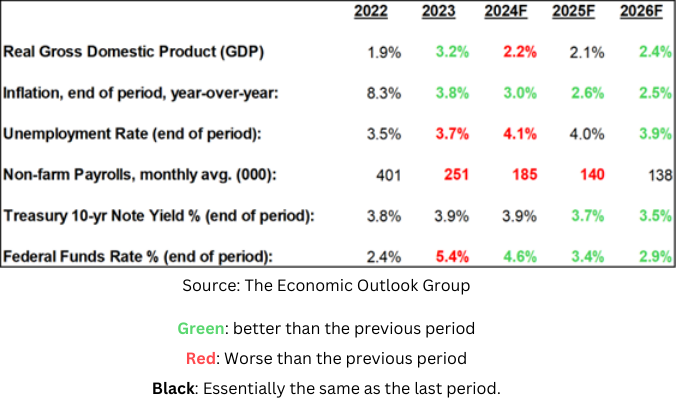

Bernard Baumohl, chief global economist at The Economic Outlook Group, was the most accurate forecaster for 2018 in The Wall Street Journal’s monthly survey. As such, I have long looked to Bernie for his economic thinking and forecast expectations. Some of his current forecasts are summarized as follows:

Analyses of the data above indicate that declines observed in The Conference Board’s monthly release over the past year, as discussed previously, will likely continue into 2025.

2025 Lodging Industry Forecast

Given the declines expected by The Conference Board and The Economic Outlook Group, and the understanding of the historical relationship between economic changes and the demand for hotel rooms, it seems reasonable that year-over-year growth in 2025 will likely be less than that achieved in 2024.

However, reviewing the available 2025 estimates prepared by the four aforementioned firms does not support this view.

A few observations:

- LARC, which had the largest 2024 occupancy downgrade of the four companies studied, is the only firm to call for an occupancy decline in 2025. CBRE, STR, and PWC call for a 0.4% occupancy increase in 2025.

- PWC and STR expect a lower room rate growth rate in 2025 than in 2024, while CBRE and LARC expect the opposite. PWC calls for no growth in the average daily rate in 2025, a stark difference from the estimate prepared by LARC.

- The net effect of these occupancy and ADR estimates results in revenue per available room (RevPAR) forecasts for 2025 ranging from a low of 0.7% (PWC) to 2.5% from LARC and 2.6% from STR.

Many economists believed a recession could be avoided if the Federal Open Market Committee (FOMC) made an initial interest rate cut of 25 basis points at its September 2024 meeting. The announced decrease increase of 50 basis points on September 18, which surprised many, is likely to support growth and stabilize a slowing labor market. More specifically, another take on this move is that the recent slowing in the labor market may now be a bigger risk than inflation.

However, it is clear that this cut in policy rates, and plans to further lower rates, is designed to support economic growth. The consensus view remains for another two 25-basis point cuts before the end of 2024. As such, and perhaps at best, economic growth in 2025 may equal that realized this year. One can hope.

My expectation is that the average U.S. hotel manager will be doing well to keep revenues flat relative to where they end up in 2024, but only the best of operators will be able to control costs to a level at which bottom-line profits actually grow.

Mark Woodworth, Principal of R.M. Woodworth & Associates and a Board Member of Hotel Investor Apps Inc., brings over 40 years of hospitality industry advisory experience, including at CBRE Hotels and PKF Consulting, to inform his perspective on the current economic outlook for the U.S. lodging industry.