Every successful hotel owner or manager knows that accurate financial management stands as a non-negotiable.

Yet, the daunting task of bank reconciliation—the meticulous cross-referencing of bank statements with financial records—often forms a roadblock, being time-consuming and susceptible to human errors.

But what if we could replace these tedious manual processes with an efficient, automated system?

That’s where automated bank reconciliation comes into play. In this guide, we’ll walk you through how to find and implement a solution.

Step 1: Selecting the Software

Not surprisingly, the first thing you’ll need to do is find software with automatic bank reconciliation capabilities. While there are multiple options available, there are a limited amount of ones that are hotel-specific.

Regardless of your choice, there are a few things you should consider when making your decision so that your chosen solution aligns with your hotel’s specific needs.

To help you make the best choice, it’s recommended that you evaluate:

- Integration Capabilities: You want your software to seamlessly integrate with both your existing financial systems and your bank so that you can easily consolidate all your financial information.

- Scalability: As your portfolio grows, your software should be able to grow with it. Choose a solution that can handle an increasing volume of transactions without performance issues.

- Ease of Use: The software should be intuitive and user-friendly, allowing your team to use it efficiently with minimal training.

- Customization Options: Each hotel has unique needs and workflows, so your chosen software should be flexible enough to be tailored according to your specific requirements.

- Support and Training: The provider should offer comprehensive training and customer support to troubleshoot any issues you might encounter.

- Security Features: Given the sensitive nature of financial data, security is paramount. Ensure your software has robust security measures in place, including data encryption and multi-factor authentication.

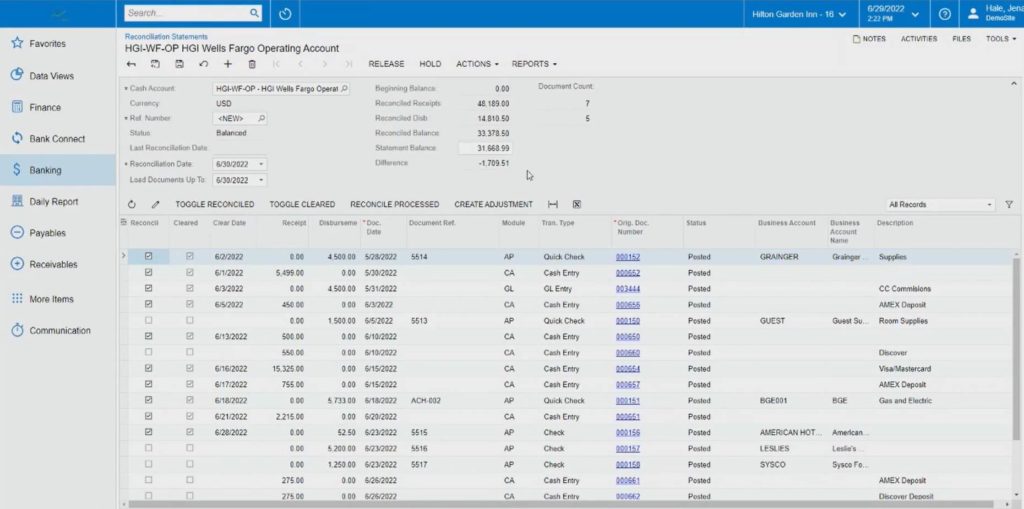

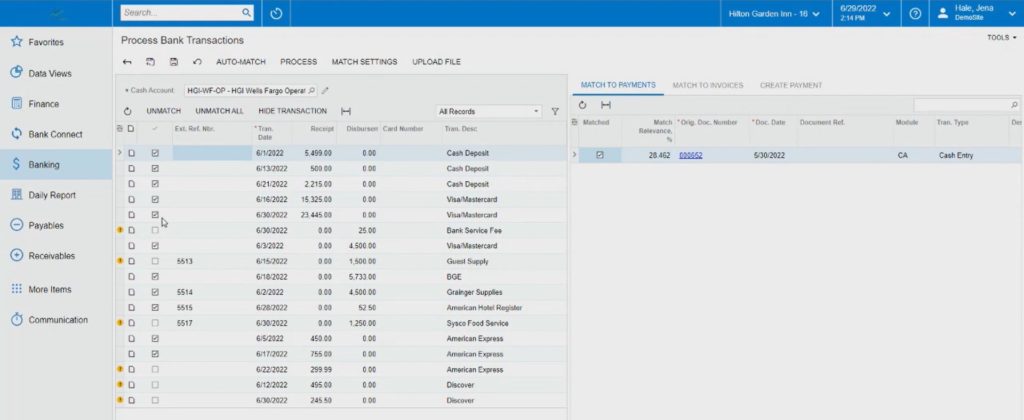

To provide a thorough and practical walkthrough, we’ll use HIA’s accounting software, specifically their BankConnect tool, for our example. Its comprehensive suite of features and capabilities allows us to demonstrate how easy automated bank reconciliation is to implement thoroughly.

Note: Your chosen tool might have slightly different steps.

Step 2: Connect Your Bank Accounts

Once you’ve chosen your software, the next step is to connect your hotel’s bank accounts to it. This process typically involves:

- Logging into your bank accounts via the software’s interface

- Confirming your identity

- Granting permission for the software to access your account information

HIA’s BankConnect tool uses a secure API connection to link your bank accounts. This means your data is fully encrypted and transferred securely between your bank and the software.

To set up the connection, navigate to the ‘Bank Accounts’ section in the tool and select ‘Add New.’ You’ll be prompted to enter your bank details and authorize the connection.

The setup is a breeze, and you can connect any account (operating, payroll, credit cards, etc.) in minutes.

Step 3: Account Mapping

Now that your bank accounts are connected to your chosen software, it’s time to match each bank account with its corresponding account in your hotel’s general ledger (GL). This process is known as account mapping, and it’s critical for seamless data transfer and efficient reconciliation.

HIA offers an intuitive and efficient mapping process, making it easy to ensure each transaction is accurately accounted for. After connecting all your accounts, you can sync them to the corresponding GL cash accounts in your accounting system with just a few clicks.

Step 4: Configure Automation Rules

Now that you have connected and mapped your bank accounts to your GL accounts, the next step is configuring the automation rules. These rules guide the software on how to automatically reconcile different transaction types.

Now each software will have its own configuration rules, but, generally speaking, you’ll need to:

Define Matching Criteria

The cornerstone of automation lies in its ability to intelligently match bank transactions with entries in your accounting system. To do this, you’ll need to define the matching criteria that the software should use. This could be based on attributes like transaction amount, date, or description.

HIA’s smart-matching feature starts working once you complete account mapping. It compares incoming bank transactions to existing entries in your accounting software and automatically reconciles matching entries.

Set up Scheduled Imports

To keep your financial records up to date, you need to ensure that bank transactions are regularly imported into the system. The frequency of these imports can usually be customized according to your needs.

HIA’s BankConnect offers the flexibility to set up these imports to be daily, weekly, or monthly. This makes it easy to manage and reconcile even the most complex transactions based on your own schedule.

Manage User Access and Permissions

Determine who within your organization has access to which pieces of financial data. This will involve configuring user roles and permissions, thereby setting visibility restrictions. This is a critical step in maintaining the privacy and security of your sensitive financial data.

Customize Report Generation

Most software will allow you to customize and automate the generation of financial reports. This is especially true with HIA’s BankConnect tool, which offers the ability to generate hospitality-specific reports by region, portfolio, or account type.

Configure Exception Handling Rules

Finally, you’ll want to set up rules for how to handle exceptions – these are transactions that don’t match any existing entries in your accounting system. You can set up rules for these to be flagged for manual review.

HIA’s tool let’s you set specific rules for every bank transaction, giving you complete control over how your entries will be created. This will help you reconcile reoccurring transactions with ease.

For more specific details on how to complete your reconciliation using HIA’s system, be sure to check out this webinar:

Step 5: Regularly Monitor and Update the System

Automation doesn’t mean you can set it and forget it. Regular monitoring and system updates are important to ensure that your automated bank reconciliation continues to run smoothly and accurately.

This involves checking for any reconciliation errors or mismatches, updating your account mapping as you add or change accounts, and tweaking your automation rules as needed.

HIA’s BankConnect tool provides comprehensive reports and alerts to make this monitoring process easy. Make sure you review these reports and act on them as necessary.

Stepping Into a Streamlined Future

Now that we’ve walked you through the ins and outs of automated bank reconciliation, you should have a good sense of how this powerful tool can change your hotel’s financial landscape.

It’s time to say goodbye to tedious manual work and step into a future that allows more time for strategic planning. HIA’s accounting software is all about making this vision a reality.

We’ve put our expertise and passion into developing a tool that’s not just powerful and reliable but also easy to use and tailor-made for the hotel industry.

When you choose HIA, you’re also choosing a partner committed to your success. We’re here to provide comprehensive training and expert advice to your finance team, ensuring you make the most of our software.

Sounds good, right? So why not take that step into a more streamlined future? Get in touch with our team to schedule a demo.

Jaime Goss has over a decade of marketing experience in the hospitality industry. At Hotel Investor Apps, Jaime heads up marketing initiatives including brand strategy, website design, content, email marketing, advertising and press relations.