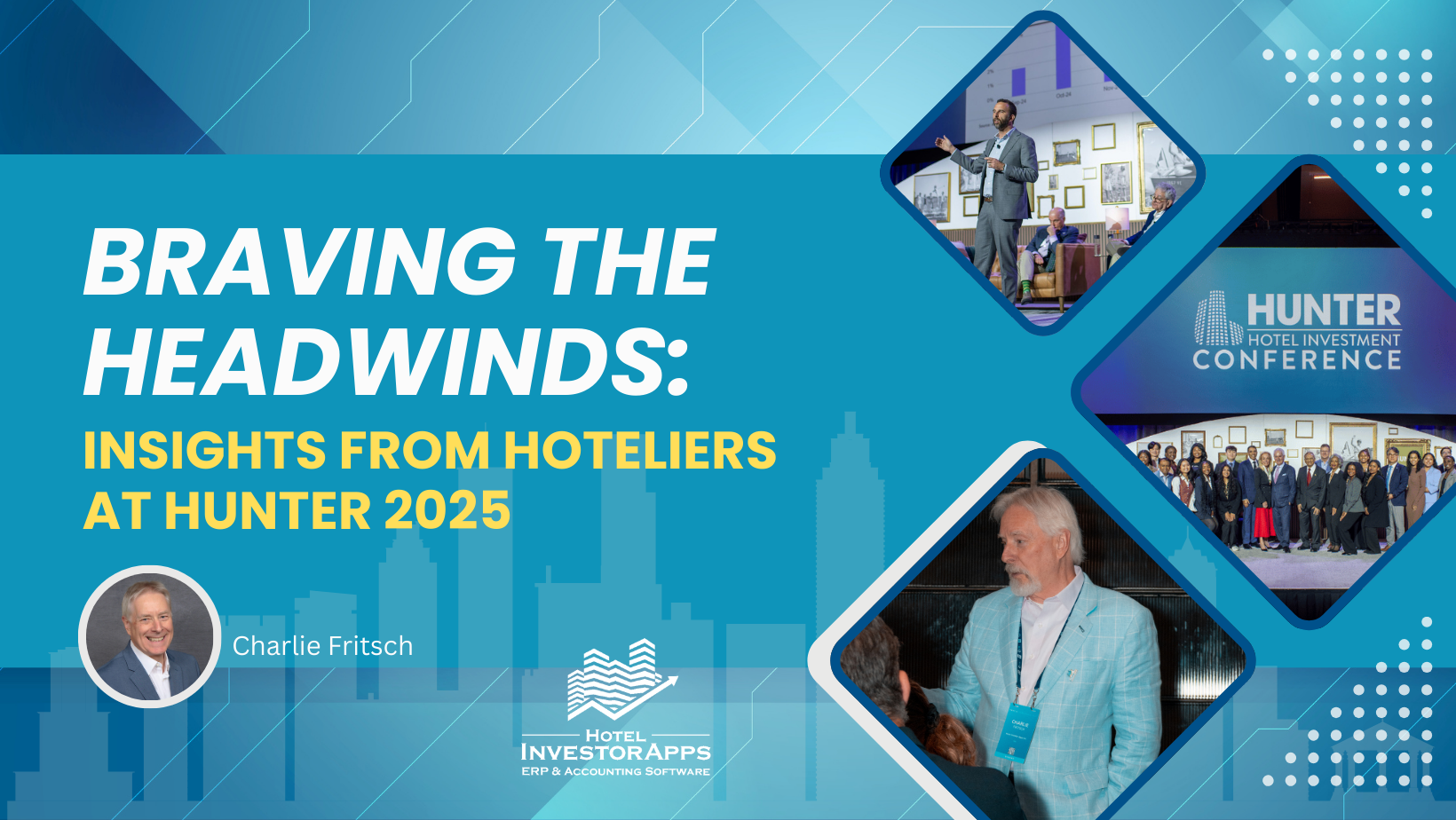

Batten down the hatches, there’s choppy water ahead! That was the main sentiment I heard while at the Hunter Hotel Investment Conference recently, with the silver lining that if hotel operators can get through the next 6 to 9 months, the 5-year forecast looks like smooth sailing.

In the short term, hoteliers are facing economic and political uncertainty and volatility, however, there are strong economic indicators which reinforce an optimistic outlook.

Current Economic Headwinds

“Survive 2025” is emerging as a mantra as the industry faces different challenges and uncertainties.

- Most US markets only reported 0.2% demand growth YOY

- The leisure segment that has propped up the industry (and can’t readily be replaced by corporate or group) is now getting weakened by inflation that is eating into travel budgets; though upper upscale and luxury hotels may be less affected.

- Tariffs, especially on Canadian building materials, are expected to increase the cost of new hotel development.

- Immigration policies could tighten an already tight labor market, further accelerating wage growth.

- Inflation is also affecting the cost of PIPs (product improvement plans), and the cost of supplies, as well as labor.

Robert Mandelbaum, of CBRE Hotels Research, stated during one Hunter Conference panel, that historically hotel expenses have often risen at a faster rate than inflation, and they are again today. The trend was briefly reversed post-covid, however, the cuts to services and amenities were not sustainable and expenses have risen again in 2023 and 2024, with hotel revenue growth lagging behind expense growth. All this puts further focus on profit margins and the need for efficient operations.

Navigating Uncertainty

Hotel operators aren’t just waiting out the storm; they are proactively taking measures to restructure operations to improve efficiency and control costs. During the Hunter Hotel Investment Conference and the HIA Hospitality Forecasts Dinner & Discussion, industry leaders shared their strategies for navigating strong headwinds. They are focused on identifying and cutting inefficiencies, leveraging technology, and making data-driven decisions to maintain profitability.

Steering Toward Efficiency–Smart Strategies for Hotel Profitability

With mounting economic pressures, hotel operators are looking at both the front of house and back of house to remove bottlenecks and friction, and are considering new technologies and processes.

Key Strategies for Efficient Operations Include:

- Leveraging Technology: By implementing a modern financial management platform (like HIA’s hospitality-specific ERP), hoteliers have a solid financial foundation offering significant time savings through automations. Read ‘Preparing to Scale’.

- Complete Financial Visibility: By consolidating all financial data (for hotels, restaurants, other businesses, and the corporate accounting) onto one accounting platform, hoteliers have the holistic view of how each asset, group or portfolio is performing.

- Managing Expenses and Cash Flow: Using business intelligence, hoteliers are identifying their most profitable hotels and implementing best practices across their portfolio.

- Negotiating with Vendors: By utilizing a global chart of accounts and global vendor list, hoteliers are able to do vendor spend analysis and negotiate better terms and discounts with vendors.

- Labor Intelligence: Understanding workforce productivity is key to labor scheduling and labor intelligence also helps hoteliers understand how labor costs affect the bottom line.

- Proactive Management: Real time dashboards and timely financial reports are delivering the insights hoteliers need to make data driven decisions to optimize top and bottom line revenues.

Hotel companies that act now to streamline operations will be well positioned to thrive in 2026 and beyond.

Read ‘Peachtree Group Implements Hotel Investor Apps ERP Software’.

Calmer Waters in the Distance

Mark Woodworth, Principal of Woodworth Core Group and Formerly of CBRE, in his presentation at the HIA Hospitality Forecasts Dinner & Discussion, offered optimism as he pointed towards growing global economic prosperity. As more people globally have resources to travel, it will bolster international leisure travel, as well as fuel business which will in-turn fuel business travel.

Though Lodging Econometrics projects strong new hotel growth, net supply change has been below long-run-average levels since 2018, according to Mark Woodworth–another factor which should boost overall profitability for the hotel industry.

The storm may not let up for a while, but the long-term horizon looks bright. By doubling down on operational efficiency, leveraging smart technology, and making data-driven decisions, hoteliers will weather 2025’s challenges and set themselves up for success. The industry’s next chapter isn’t just about skirting the wind—it’s about laying a course to seize the opportunity that lies ahead. Those who steer their operations wisely today will be the ones sailing into a prosperous future.

Charlie Fritsch, CEO and Founder of HIA, is dedicated to providing hoteliers with top-tier financial management and business intelligence tools. Bringing 30+ years of hospitality industry experience, when Charlie founded HIA in 2015, he set out to not only improve the business outcome of hospitality companies, but to improve the quality of life for employees across the organization with easy to use software which offers automations to reduce manual labor and improve accuracy while delivering better insights.