Patterns After Past Recessions Playing Out Again and How they May Affect US Lodging for 2025 and Beyond

“If I had ever been here before … I would probably know just what to do…”

David Crosby wrote these lyrics in the late 1960’s, a time when the war in Vietnam was at full force and the U.S. was entering economic recession. The relatively mild 1969 recession followed a lengthy expansion, at the end of which inflation rose. This relatively mild recession coincided with an attempt to start closing the budget deficits of the Vietnam War (fiscal tightening) and the Federal Reserve raising interest rates (monetary tightening). Some of this sounds familiar.

Story of Three Recessions

Since the start of this century, we have experienced three recessions: March – November 2001 (9/11 and the Dot.Com bubble); December 2007 – June 2009 (Great Financial Crisis – GFC), and February – April 2020 (the pandemic). All three had very different contours (depth and duration), which may be explained by the principal cause associated with each contraction.

- The bursting of the Dot.Com bubble, followed by the terrorist attacks of September 11, 2001 caused a three-quarter length downturn in the economy.

- The 2007-2009 recession was caused by excessive mortgage lending to borrowers who normally would not qualify for a home loan. The subsequent government-funded bailout of the banking system, and multiple Fed programs focused on supporting financial markets and reducing persistent high unemployment levels (specifically – low interest rates for longer).

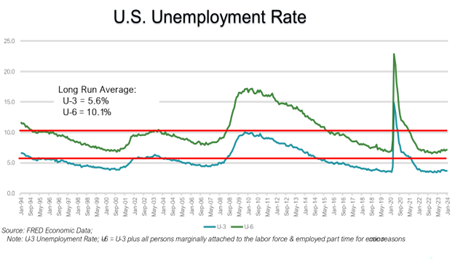

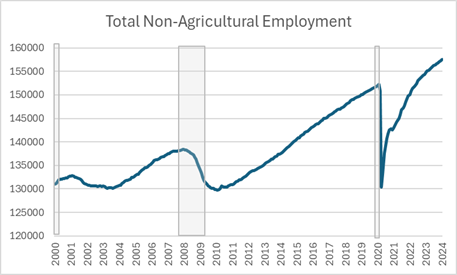

- The recession of early 2020 was clearly a result of the public health crises that was of global proportions – COVID 19. Significant public resources were deployed in an effort to support the millions of workers that were quickly left unemployed (see Chart 1).

Impact on the Lodging Industry

As would be expected, the three episodes described above negatively impacted lodging industry fundamentals. As one thinks about the road ahead, it seems appropriate to ask: “Have we been here before?”. Maybe yes, maybe no.

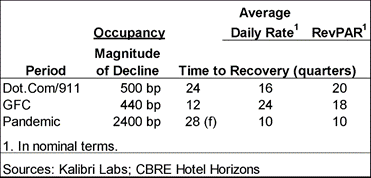

The following table (Table 1) summarizes the impact on three key industry measures (occupancy, average daily rate, and Revenue per Available Room – RevPAR) that resulted from the three most recent economic contractions in the U.S.

Table 1

The degree of impact and length of time to recovery (defined as the amount of time required to return to the market occupancy, nominal average daily rate and RevPAR levels that existed prior to the downturn) varied considerably across all three episodes. Select observations of the data above include:

- The magnitude of the pandemic-driven decline in occupancy level dwarfed that realized during the previous two downturns. The expected extended (i.e. longer than the Dot.Com/911 episode) return to the pre-pandemic occupancy level of 67.3% (forecast to be late 2026) seems reasonable, particularly when considering the following:

- The Short Term Rental (STR) industry was a small fraction of its current state back in 2002 and 2012 – AirBNB had yet to be invented. STRs have clearly evolved as a legitimate alternative to traditional lodgings.

- Technological alternatives to in-person interaction, in the face of the pandemic, has led to reduced corporate travel and fewer meetings and conventions. These have clearly been mainstays of traditional sources of demand.

- The declaration of a global crisis by the World Health Organization in March 2020 had the immediate effect of eliminating all but essential international travel, another important source of demand for U.S. hoteliers .

- The comparatively fast nominal recovery of the industry-wide average daily rate and RevPAR levels following the pandemic period seems to betray a basic premise of the relationship between supply, demand, and pricing. Specifically, the steep decline in occupancy levels and an extended period of excess supply (the 28 quarter forecast path to pre-pandemic levels) would suggest weakened pricing power for hotel managers. The opposite has been true (no Déjà Vu here).

Personal Income Drives Pricing Power

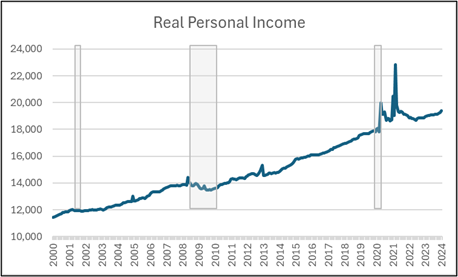

Research from my friend and former colleague Jack Corgel, professor Emeritus from Cornell University and currently with Cordial Hotel Property Research finds that changes in lodging demand are heavily influenced by changes in total employment and real personal income. Charts 2 and 3 illustrate the change in employment and real personal income since the year 2000 (recession periods shaded).

Chart 2

Chart 3

Even though the level of employment in the U.S. remained well below that which existed at the beginning of 2020 (see Chart 2), there was a significant spike in the volume of real personal income (driven by government-funded stimulus payments) in 2021 and 2022 (Chart 3). Fortunately for many hoteliers, particularly those located in leisure destinations, much of this elevated personal income found its way into the domestic lodging industry. Now that both real personal income and employment increases have returned to trend behavior, much more modest increases in ADR and RevPAR have been, and will continue to be, realized in the near to mid-term.

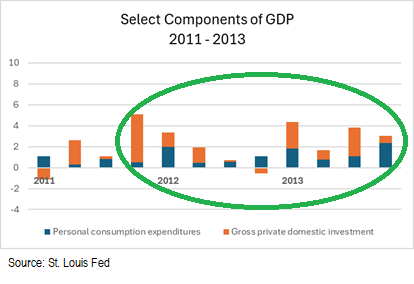

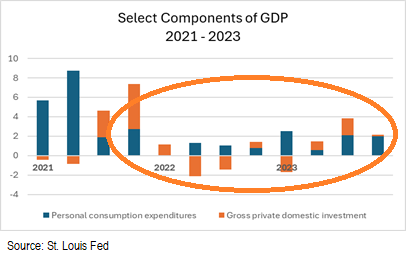

Additional industry research led by Jack Corgel reveals that changes in lodging demand relate closely to changes in personal consumption expenditures and gross private domestic investment (two of the traditionally larger components of Gross Domestic Product). To further illustrate the similarity (or difference?) between the pandemic contraction and the GFC episode, we compare the changes in these two economic variables for the three-year period following the end of the recession.

Chart 4 – Great Financial Crises

Chart 5 – COVID 19

Analyses of Charts 4 and 5 clearly indicate that economic growth in the form of personal consumption expenditures and gross private domestic investment in this most recent episode have been much weaker than what was realized during the comparable period following the GFC. Not surprisingly, data from Kalibri Labs indicate that year over year demand levels within the Economy segment have been declining since Q2 2022 as well as in the Midscale segment (since Q3 2022). Demand declines were realized in the Upper Midscale and Upscale segments in Q4 2023. The U.S. lodging industry has been here before – things are slowing down.

Near Term Trends

The list of known unknowns today is largely familiar: when will interest rates recede? Will the elevated levels of global unrest persist? Who will win the presidency? Who will control Congress? What will the drivers of GDP change be? Etc. etc.

Some data from the most recent Wall Street Journal Economic Survey (January 2024) indicate the following:

- The 10-year Treasury Yield (at 4.09% as I write this vs. 3.64% a year ago) is forecast to decline to 3.4% by year-end 2024, decreasing further to 3.25% by mid-year 2025).

- Real GPD, which increased by 2.65% in 2023, is forecast to grow 1.01% in 2024 and another 1.99% in 2025.

- The year-over-year level of inflation is forecast to be 2.7% by June 2024, 2.33% by December 2024, 2.22% by June 2025 and 2.25% by December 2025.

- The unemployment rate (currently at 3.90%) is forecast to be 4.11% by June 2024, 4.30% by December 2024, 4.22% by June 2025, and 4.13% by December 2025.

Two more observations to consider:

- Domestic TSA throughput reached 110 % of the 2019 level in February 2024 – people are travelling more and more.

- Share prices of many of the publicly held lodging firms have been increasing at a faster rate than the S&P 500 since mid-February – a duration last seen in late 2019 and early 2020 – just before signs of the pandemic began to appear.

Forecasting 2025 and Beyond

My take on the above: the next four-to five quarters for the U.S. lodging industry will be modestly positive; certainly not great. Positive- yes; negative – no. Longer term (the back half of the 2020’s) should be some of the best years our industry has ever seen, driven by the following:

- Net supply change has been below long-run-average levels since 2018 and will likely remain low for the balance of this decade.

- The aging of the domestic population, along with changing work habits, will continue to provide even more time away from home for travel. Many of these people will have the economic means to make a trip, and they will do so.

- Inbound international travel is poised to recover to pre-pandemic levels in the near-to-mid-term. Gateway city hotels in particular will benefit.

- Millions of people have found their way into the United States over the past three years, and they have begun to (slowly) enter the labor force. Hotels will be one of the primary beneficiaries of this trend as downward pressure on labor and related costs, resulting from this elevated supply of workers, should evolve in the near-to-mid-term.

On net, some new but largely Déjà Vu in terms of steady growth often seen after a recession.

R. Mark Woodworth

Woodworth Core Group

Mark Woodworth, Principal of R.M. Woodworth & Associates and a Board Member of Hotel Investor Apps Inc., brings over 40 years of hospitality industry advisory experience, including at CBRE Hotels and PKF Consulting, to inform his perspective on the current economic outlook for the U.S. lodging industry.