R. Mark Woodworth is Principal of R.M. Woodworth & Associates and a Board Member of Hotel Investor Apps Inc.

According to Kalibri Labs, U.S. national RevPAR levels began to exceed their 2019 benchmark in March of this year, well ahead of what most prognosticators had anticipated in the early days of the pandemic. Most noteworthy is the fact that managers have been able to exceed their 2019 peak room revenues by achieving solid increases in average daily rates while selling fewer rooms. This, combined with reduced staffing levels resulting from labor shortages in virtually all markets, has led to favorable increases in profitability. While lodging fundamentals have improved dramatically over the past two years, many see threatening clouds on the horizon. These include:

- Business and consumer confidence levels continue to plummet.

- The U.S. stock market is in bear territory.

- Where have all the workers gone?

- Energy costs are through the roof, followed closely by salaries and wages.

- Airfares are also through the roof while the number of daily flight cancellations grows.

- Inflation rates are at a 40-year high.

- The Federal Reserve has begun the process of increasing interest rates to tame these escalating price increases.

- Many leading economists say the question of recession is not if, but when.

- Etc., etc.

Given this initial list of ills that characterize the United States economy as we enter the third quarter of 2022, what should hoteliers expect for the remainder of this year and, as the budget season begins, the year ahead in 2023? More growth? A reversal of recent trends? Something else?

History tells us that past industry downturns have been caused by one or more of the following factors occurring simultaneously:

- Catastrophic event (i.e., September 11) – one cannot predict this.

- Overbuilding – no sign of this in most markets.

- Asset price bubble – may be in housing markets, but this seems remote.

- A weakening economy – the 1st half of 2022 has certainly been soft.

- High oil prices – bingo!

While recession probabilities for the next 18-month period have recently increased to around 40 percent, most economists believe that a downturn would be modest in duration and that the contraction would be somewhat mild. It appears that high oil prices are here to stay for a while and, as such, inflation will remain elevated and consumer travel habits will likely be negatively impacted. Previous research by my former colleague Jack Corgel of Cornell University revealed that, while vacationers still make the trip, they trade down in the lodging and food-away-from-home purchases. It is also important to note that household income levels relative to household debt obligations remain well above historical norms, thus suggesting that many people have the economic means to travel. Booking patterns for the current summer season seem to bear this out.

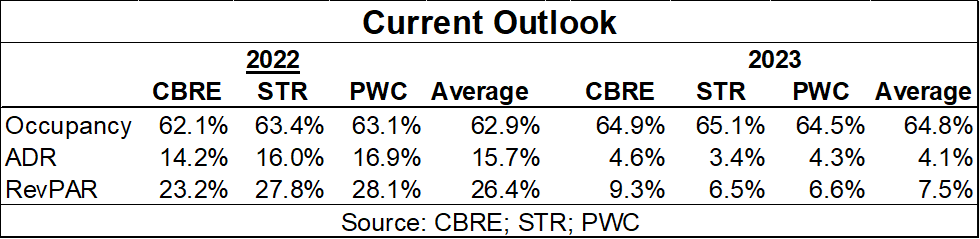

Three of the larger forecasting firms with a focus on the lodging industry released their updated forecasts at the NYU conference in early June and were all generally consistent in their outlook for the remainder of this year and for 2023. These estimates are summarized in the following table:

Select observations of these data include:

- The estimates for 2022 reflected each firm’s expectations for the domestic economy as of late April or May as well as four or five months of actual hotel performance data. This expected a higher level of accuracy would suggest that we should finish this year in comparatively decent shape.

- Each firm’s outlook for 2023 calls for another year of attractive growth in both occupancy and average daily rate. Even if they end up being 50 percent off, it would still be a good year for hotels.

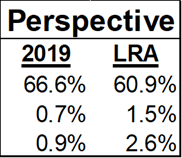

- The table below shows Kalibri Labs reported data for 2019 (the common benchmark year for many in terms of how ‘recovery’ is defined) as well as the 20-year Long Run Average (LRA). Comparing these data to the forecasts summarized above for 2023 further underscores the potential for next year to be a good one for U.S. hotels despite the elevated uncertainty and economic concerns that currently dominate the headlines.

To sum things up, lodging markets within a 3–5-hour drive of major markets should continue to perform well; corporate and group travel (elements of which have been ‘pent-up’ for over two years), will continue to slowly return to the bigger cities. Price gains will continue to be attractive – well-above long-run average. 2023 will be okay but not great; however, the longer-term outlook remains strong. Concerns over labor availability and cost will persist.

Mark Woodworth, Principal of R.M. Woodworth & Associates and a Board Member of Hotel Investor Apps Inc., brings over 40 years of hospitality industry advisory experience, including at CBRE Hotels and PKF Consulting, to inform his perspective on the current economic outlook for the U.S. lodging industry.